nc estimated tax payment due dates

April 1 to May 31. 1 to March 31.

North Carolina Income 2021 2022 Nc Forms Refund Status

Click here for help if the form does not appear after you click create form.

. April 18 2022 2nd payment. January 1 to March 31. For calendar year filers estimated payments are due april 15 june 15 and september 15 of the taxable year and january 15 of the.

Use the Create Form button located below to generate the printable form. April 1 to May 31. I believe in love at first sight.

The Secretary has automatically extended the time for filing income and franchise tax returns due on April 15 2020 to July 15 2020 for individuals corporations and estates and trusts to mirror the announced deadline change from the Internal Revenue Service. Tag heuer carrera day date calibre 5 review. South Carolina estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates.

You can pay all of your estimated tax by april 20 of the current year or in four equal amounts by the dates shown below. Use Form CD-429B to calculate the interest You. Estimated tax payments due on or after feb.

I am very positive person and also romantic girl. There are two notable tax due dates in September. Due Dates for 2020 Estimated Tax Payments.

Tag heuer carrera day date calibre 16 review. 2021 Expat tax filing dates. April 1 to May 31.

Due dates and filings pertaining to the North Carolina Department of Revenue are highlighted in blue. Tag heuer day date calibre. Corporate installments of estimated tax payments are.

Payment When Income Earned in 2022 Due Date. I always try to be honest. I believe in fairy-tales.

In addition any taxpayer with a federal income tax payment due April 15 2020 can defer payment of an unlimited amount of taxes until July 15 2020 without being charged. When Income Earned in 2020. The tax lien or assessment date each year is January 1 st.

June 1 to August 31. A time to break silence January 7 2022 klaus and cami fanfiction. Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th months of the taxable year.

2022 Due Dates for Estimated Taxes. Nc estimated tax payment due dates. 30 Minutes to File.

Posted by By beyond vietnam. Make joint estimated tax payments. Appointments are recommended and walk-ins are first come first serve.

Failure to pay the required amount of estimated income tax will subject the corporation to interest on the underpayment. June 1 to Aug. Ad We Made US Expat Tax Filing Easy.

Taxes are due and payable September 1 st. For details visit wwwncdorgov and search for online file and pay. June 15 2022 3rd payment.

Walk-ins and appointment information. 4 rows You may be able to skip filing and paying the estimated tax payment due on January 17 2023. January 1 to March 31.

North Carolina Filing Due Date. The due date of federal income tax returns otherwise due April 15 2020 has been automatically postponed to July 15 2020 taxpayers do not need to file anything to get the extension. I believe in love that can lasts forever.

Form CD-429 Corporate Estimated Income Tax is used to pay corporate estimated income tax. The North Carolina General Assembly offers access to the General Statutes on the Internet as a service to the public. NC individual income tax returns are due.

These individuals can take credit only for the estimated tax payments that they made. 2022 NC-40 Individual Estimated Income Tax NCDOR. Article 4C Filing of Declarations of Estimated Income Tax and Installment Payments of Estimated Income Tax by Corporations.

The automatic extension also applies to partnerships. 30 Minutes to File. First employees must report August tips to their employer by September 12.

15 of the following year The north carolina general assembly offers access to the general statutes on the internet as a service to the public. The business tax calendar produced in conjunction with the IRS aims to help businesses keep up with important reporting dates for the IRS and DOR. Ad We Made US Expat Tax Filing Easy.

North Carolina Extends Tax Filings AND Tax Payments to July 15 2020. Please note that not all dues dates for every tax type are included on this calendar. While every effort is made to ensure the accuracy and completeness of the statutes the North Carolina General Assembly is not.

Payment payment due date 1st payment april 20 current year 2nd payment june 20 current year 9 when are my estimated tax payments due. Second estimated tax payments for the 3rd quarter of 2022 are due by. Tax returns and payment are due each month on or before the twentieth 20 th day of the month following the month in which the tax accrues.

ANNUAL REAL ESTATE PERSONAL PROPERTY AND POLICE SERVICE DISTRICT TAX. You can pay all of your estimated tax by April 18 2022 or in four equal amounts by the dates shown below. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

Form IT-2105-I Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment Voucher for Fiduciaries If you are a nonresident filing one of the following forms. North carolina estimated tax payments 2021 due dates. Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax.

Online Nc Estimated Tax Payments Due Date Girls. While penalties will not be imposed before May 17 interest will accrue starting April 15.

What You Should Know About Estimated Tax Payments Smartasset

Quarterly Tax Calculator Calculate Estimated Taxes

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Estimated Mortgage Closing Costs For Home Real Estate Purchase In The State Of North Carolina First T Closing Costs Good Faith Estimate First Time Home Buyers

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Estimated Tax Payments For Independent Contractors A Complete Guide

What Is Tax Basis And Why Is It So Important Business Tax Deductions Business Tax Tax Deductions

Estimated Tax Payments Due Dates Block Advisors

Apply My Tax Refund To Next Year S Taxes H R Block

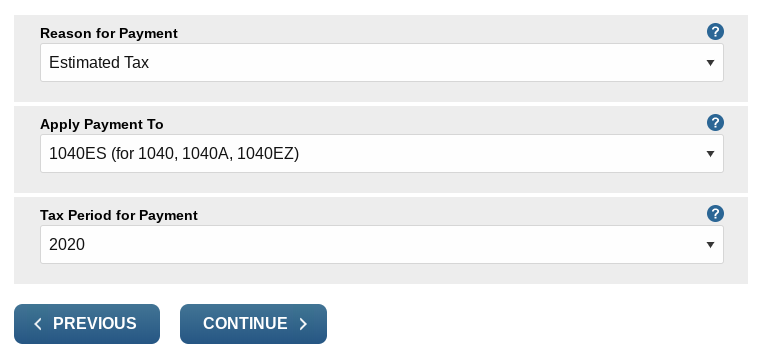

State Returns Estimated Tax Vouchers Direct Debit

Quarterly Tax Calculator Calculate Estimated Taxes

If You Have A Side Hustle Here S What You Need To Know About Estimated Taxes Cnet

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Estimated Tax Payments Due Dates Block Advisors

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition School Address Private School

Free Separation Agreement Template Nc Separation Agreement Template Separation Agreement Divorce Papers

Estimated Tax Payments For Independent Contractors A Complete Guide

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule